At Bank of Ireland we wish to make it even simpler so that you can handle and develop your enterprise. While having a fair to poor credit rating may appear to preclude you from most loan options, there are various different and on-line lenders that now cater to business owners who can’t qualify for conventional loans from banks and credit score unions.

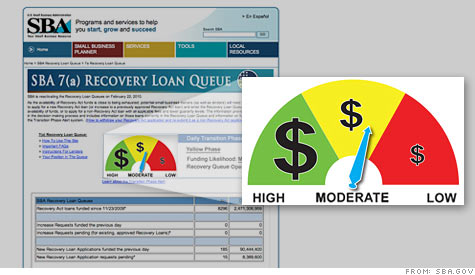

Ease of utility course of: Up to now, bank and SBA loans had been infamous for lengthy software processes, but as lending has moved on-line, debtors are looking for loan purposes which might be straightforward to finish. Like with commonplace 7(a) loans, Specific loans are extraordinarily versatile, making them a superb selection for most enterprise needs.

If you can’t qualify for a business mortgage by Lending Club, think about taking out an unsecured personal mortgage via this lender. Companies whose house owners have a credit score score of not less than 640 are most definitely to qualify. Many SBA loans require lots of paperwork and documentation to apply, and you will need to get in contact with a financial institution in your space that makes all these loans.

They have a series of services and packages together with an Online Women’s Business Heart that offers ladies entrepreneurs specific recommendation and guidance as to how one can get more womens enterprise loans. Some borrowers find making a big fee each month is a larger burden on their enterprise than weekly or day by day funds.

Rates at Credibly are also decrease – typically 9.ninety nine{1ec33346f394c8709a69a5c4dd43fdb0821c00a81f3e17f85483c6174c3b2847} to 36{1ec33346f394c8709a69a5c4dd43fdb0821c00a81f3e17f85483c6174c3b2847} APRs, though they could be greater relying in your qualifications – than different various lenders which have lenient credit necessities. Each lender evaluates companies in a different way, and every enterprise has a distinct monetary makeup.