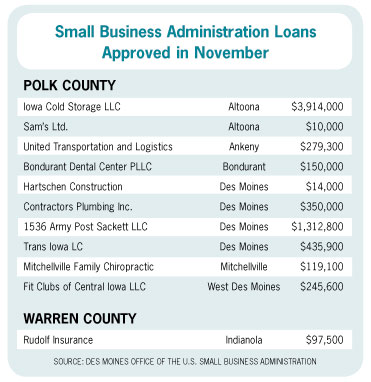

SBA Loans ‘ Small Business Administration Loans

Bank of Commerce is acknowledged as a Most popular Lender by the U.S. Small Business Administration. Along with business training providers, sixty eight{1ec33346f394c8709a69a5c4dd43fdb0821c00a81f3e17f85483c6174c3b2847} of WBCs provide mentoring providers, and 45{1ec33346f394c8709a69a5c4dd43fdb0821c00a81f3e17f85483c6174c3b2847} present microloans. It has been a goal of conservative Republicans, who tried to get rid of the company throughout the Clinton administration and often tried to chop its budget.

To help push our agenda forward, I’m pleased to appoint Linda McMahon as the top of the Small Enterprise Administration,” Trump said in a press release released Wednesday. McMahon spent about $one hundred million of her own fortune on the campaigns — about double what Trump spent on his presidential run.

Each bank has its own inner credit score customary and coverage for approval of its loans. That is why homeowners of small businesses flip to business administration grants for safety. Aside from giving loans out themselves, Small Business Administration will also stand as surety for people and assist them get loans from elsewhere.

The SBA runs special help facilities and women’s business centers to train the women technically. Sometimes, a new applicant should inject 33 percent of the whole funds needed to start out a new business. The First Annual …